How to Earn Money Staking Crypto

How to Earn Money Staking Crypto

Staking is an important aspect of cryptocurrencies that many people have never been exposed to.

What is Staking?

Staking crypto is a way to earn interest or rewards by locking down your coins for a certain amount of time. Like many crypto topics, staking can be very simple or very complex depending on the context and how deep you go. Some cryptocurrencies, like Cardano, rely on staking as a means of securing the network and certain exchanges support “soft staking” many coins for interest. While both of these scenarios use the word “staking”, they are functionally very different and shouldn’t be confused with each other.

Both staking and soft-staking offer a way to earn crypto by holding onto it for a certain amount of time, however, soft-staking works differently with every exchange. This post focuses on how some blockchains use staking to maintain the security of the network through an algorithm called Proof of Stake. By staking certain cryptocurrencies someone can earn around 4-5% back annually. While 5% may not sound massive, it is a considerably larger return than a traditional savings account offers and can be a great option for someone looking to hold their coins anyway.

How Staking Works

Some examples of blockchains that support staking natively are Cardano, Cosmos, Tezos, and soon Ethereum 2.0. In this post I will use Ethereum 2.0 as the primary example since it is the largest project working to utilize staking over mining.

The reason these cryptocurrencies reward users for staking their coins is because they use them to secure the network. These networks employ what is called a Proof of Stake consensus protocol as opposed to a Proof of Work protocol, which is what secures Bitcoin and Ethereum. In order to properly understand Proof of Stake, let’s first cover what consensus protocols are.

Consensus Protocols

It is difficult to explain why staking exists without first discussing consensus protocols. Banks can manage all of their transactions and accounts because they have a central point of control that oversees the entire process; every time you deposit a check or send someone money, a bank employee is verifying that your transaction is valid. In contrast, most cryptocurrencies are decentralized, which means there is no central organization to manage the system.

Lacking this central point of control has many upsides, however, it also introduces the critical issue of ensuring all transactions are valid and the majority of participants — called nodes — agree on the state of the network at any given time. This problem of making sure that all of the participants of a distributed system agree is called consensus, and without a way for a decentralized network to achieve consensus, it will fail.

Blockchain uses nodes, which are computers attached to the network, to keep track of the state of the blockchain at any given time. When new transactions are added, the many nodes on the network have to reach a consensus on the new state of the network. This is where consensus protocols come into play. Each protocol is an algorithm that aims to provide nodes with a method of reaching consensus on the state of the network anytime a change occurs. There isn’t a one size fits all consensus algorithm because each blockchain is different and presents its own challenges. Let’s discuss the two most used consensus protocols to help give this information more context.

Proof of Work

Bitcoin made blockchain networks, as we know them today, possible by implementing something called Proof of Work (PoW) as a consensus protocol. The creators of Bitcoin didn’t invent PoW, however it was one of the first major systems to utilize it as a means of securing a decentralized network. PoW allows for a single entity to prove to others that some amount of computational work has been expended, and others can easily verify that this work has been done. Bitcoin accomplishes this by having miners use computational power in a race to solve cryptographic puzzles; the more computational power used by a single entity, the higher the likelihood of solving the puzzle first.

The first entity to solve the puzzle gets to mint a new block of transactions onto the blockchain in exchange for a reward. It is key to remember that the purpose of PoW isn’t to obtain the puzzle’s solution, but rather to prevent manipulation of the network by requiring a high level of effort to be able to mint a single block of transactions. This means that tampering with the network would require a huge amount of computational power that exceeds 51% of the network’s total power.

PoW works quite well for simple cryptocurrencies like Bitcoin, which focuses primarily on tracking transactions. However, a network like Ethereum that has many different applications running on its blockchain is too complex for PoW to scale efficiently. This leads to bottlenecks when the network is busy, and ultimately causes high fees and long transaction times. I am writing a post specifically about Ethereum’s transition away from PoW, but for now, it is simply important to understand that requiring miners to solve endless cryptographic puzzles can be an inefficient way to achieve consensus; to solve the issues with Proof of Work a new consensus protocol called Proof of Stake was created.

Proof of Stake

Proof of Stake (PoS) is a fairly new consensus protocol that promises improvements in speed and efficiency while reducing the energy required to function when compared to PoW. Instead of having miners race to solve cryptographic math problems, transactions get validated by coin holders who put their coins on the line to back the validity of the transactions in a new block.

Miners who previously invested computational power for a chance to add a new block to the chain will instead stake coins they own for the same chance. Staking allows for an individual to create a validator node and partake in maintaining consensus among all of the nodes on the network.

If a validator node is chosen to add a new block to the chain, their staked coins serve as a guarantee that the new transactions are legitimate. The network then selects validators to check that the transactions are correct; if the validators find that new transactions are invalid, then the staked coins are burned in what is called a slashing event. If the validators find no issues with the new block then the owner is rewarded and the block is minted onto the chain.

The specific ways that the network chooses nodes to mint new blocks varies depending on the network, however, it generally involves some level of randomization and is weighted in favor of larger stakes. This is why staking, like mining, is often done in pools that allow individuals to combine their resources and be more competitive. Unlike mining, since the selection is randomized, even validators with small stakes receive consistent rewards over time; this is why staking pools can offer a fixed percentage of return over time.

Proof of Work vs. Proof of Stake

One main benefit of Proof of Stake is that it consumes much less electricity than Proof of Work does. Since PoW requires miners to race to solve complex cryptographic problems, a ton of high-energy hardware is constantly working to solve the next problem. Because only one entity can “win” the race, the many other miners who didn’t win spent resources without any return. This leads to massive energy consumption and is often one of cryptocurrency’s largest criticisms. PoS eliminates nearly all of this energy consumption since there is no mining and validator nodes require very little power to maintain consensus on the network.

Another benefit of PoS is that it is much easier to create a validator node than with PoW. In a PoW system, most nodes are run by miners since they are the only ones with incentive to provide computational power to the network. Lowering the bar to creating validators helps ensure that the network remains decentralized and resistant to attacks.

How To Stake Your Coins

If a cryptocurrency uses a Proof of Stake protocol, then there are generally ways to stake the coin built into official wallet apps. For example, Cardano recommends a couple of wallets, like the Yoroi wallet. Inside the Yoroi wallet app, you can join staking pools and easily stake your coins. Cardano makes staking extremely simple, however not all PoS coins have as easy of a system. Different coins also have different policies on the duration of time your stake is locked down, meaning you can’t withdraw it for a certain number of days.

ETH 2.0 requires a large minimum stake — 32 ETH — and doesn’t make joining pools quite as simple as Cardano does. Finding an Ethereum staking pool is a lot like choosing a mining pool, there are quite a few options that the Ethereum foundation recognizes but doesn’t officially endorse. Choosing a staking pool is more complex than a mining pool since the method of staking used determines whether or not you hand over control of your coins to someone else.

Most Ethereum staking is custodial, which means you give an entity some amount of ETH and then they stake it for you. This could be an exchange like Crypto.com/Binance/Coinbase or a stand-alone pool. The downsides of custodial staking are the concentration of ETH into centralized points of control and that individuals do not control the keys to the coins they stake.

Liquid Staking

Even the majority of stand-alone pools only offer a pseudo-decentralized approach by employing liquid staking. Liquid staking is a system where you are issued a tokenized version of the coin you staked and those tokens can be transferred, stored, or spent. This method of staking usually eliminates the “freezing” of staked coins and allows for withdrawing your stake at any time by converting your tokens back into ETH.

Designing a method of staking ETH in a pool that is truly decentralized and allows you to maintain ownership of your keys is a difficult task, but Rocket Pool seems to have the best solution that achieves both. A full explanation of Rocket Pool belongs in its own post as it is quite complex, however, I will break down the basics here.

- Rocket Pool allows individuals to stake as little as 0.01 ETH into their staking pool and gives them rETH in return.

- Rocket Pool creates a validator node by combining a 16 ETH stake from a person/organization with 16 ETH that was staked into the pool by individuals.

- To the Ethereum network, this validator node appears the same as any other, however, it is functionally a “minipool”. The only difference between a normal validator node and a minipool is how they were created and how withdrawals function.

- Rocket Pool uses smart contracts to manage everything done by minipools, which makes the system completely decentralized and doesn’t require stakers to hand their keys over to a central point of control.

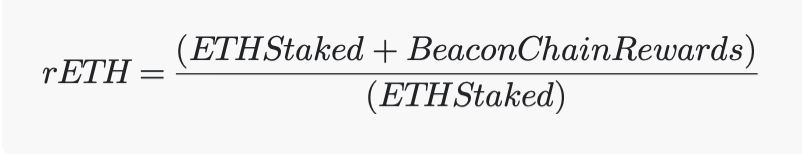

The whole system that Rocket Pool has created is quite elegant. The value of the rETH token is handled by a ratio:

Since the Beacon Chain issues consistent rewards, the value of a single rETH token is always increasing relative to the value of a single ETH coin. What’s interesting about this method is that even if you just purchase rETH on an exchange, you are technically benefiting from staking with the pool since its value will grow relative to ETH over time.

Risks of Staking

The primary risk of staking Ethereum is the chance of a slashing event occurring. When it has been found that a validator node has done something incorrectly it can be forced to exit the network and has its staked burned. This is the network’s way of deterring validators from attempting to tamper with the validity of data uploaded to the network. When staking in pools there is a small chance of this occurring, however many pools have methods to minimize this risk. Rocket Pool takes any losses due to slashing and spreads the cost out to everyone, which makes the impact to each individual very small. The risk is low, however, otherwise Proof of Stake wouldn’t be a very sustainable alternative to Proof of Work.

It is important to understand how slashing events are handled by the pool or exchange you choose to stake your coins with since some options offer more protection than others.

Wrapping Up

Staking is an important topic of cryptocurrencies to understand, especially with Ethereum transitioning to Proof of Stake in 2022. With more and more people holding onto their coins for longer periods of time staking can be a great way to earn interest while doing so.

Just be sure that you understand the terms when you stake your coins. Different currencies and staking pools have varying rules on how long your coins remain staked and how rewards are paid out. For example, Ethereum currently only supports depositing staked ETH as the developers have not added a way to withdraw staked ETH yet. Pools often have ways to allow small stakes to be withdrawn, however many ETH 2.0 stakes will be frozen until the official launch in 2022.

Post a Comment